Sep 26, 2022

Bank of India- A Leading Nationalised Bank for Studies Abroad Education Loan

We are pretty sure there is at least one person in every family who has a Bank of India account. Well, with over 5,300+ branches in India and a presence in 15 foreign countries across five continents, it does make sense as well! Its global presence includes cities like Tokyo, Singapore, Hong Kong, London, Paris, New York, Dubai, etc. And yes, that is a lot for a nationalised bank! Maybe this is exactly why many Indian students naturally look at Bank of India when it comes to overseas education loans.

It also gets the benefit of trust as nationalised banks are usually the first choice of Indians. There are clear reasons for that, like lower interest rates, strong government backing, and the ability to offer higher loan amounts. So, among the twelve nationalised banks in India, today, let us know everything about the Bank of India abroad education loan, better known as the Star Education Loan.

About Bank of India Abroad Education Loan – Star Education Loan

Bank of India offers a range of education loan options to support students who wish to pursue higher studies in India as well as abroad. These include the Star Education Loan, Star Vidya Loan, Star Progressive Education Loan, and the Star Pradhan Mantri Kaushal Rin Yojana, etc.

Among these, the Star Education Loan is the primary scheme for students planning to study overseas. The Star Education Loan follows the Indian Banks’ Association (IBA) Model Education Loan Scheme, which was introduced in 2001 specifically aimed at providing financial support for recognised courses at international institutions, from postgraduate and undergraduate programmes to professional and specialised courses.

Features of Bank of India Abroad Education Loan

Let us have a structured look at the key features that define the Star Education Loan for abroad studies:

|

Particulars |

Star Education Loan

for Abroad Studies |

|

Loan Amount |

Secured Loan Up to Rs.1.5

Crores |

|

|

0.50% Concession for

100% Collateral Security & Loan amount above Rs.20 Lakhs. 0.50% Concession for

Top 1000 QS World Universities & Loan amount above Rs.20 Lakhs. 0.50% Concession

for Medical, Engineering and Management Courses. |

|

Funding & Loan

Margin |

Above Rs.1.5 crores: 75% + 25% (with

each Disbursement) |

|

|

|

|

Repayment Period |

15 years from the

date of disbursement |

|

|

|

|

Moratorium Period |

Course Duration + Up

to 12 months |

|

Processing Time |

20 to 30 Days |

Features explain how an education loan to study abroad works. But students don’t live inside feature lists, right? They live in hostels, rented rooms, classrooms, grocery stores and experience centres. So let us move from policy language to real-life spending and see exactly what the Bank of India's abroad education loan is designed to pay for. Because a loan only becomes useful when it covers the things students actually spend money on.

Unlock Your Study Abroad Dream: Rates Slashed!

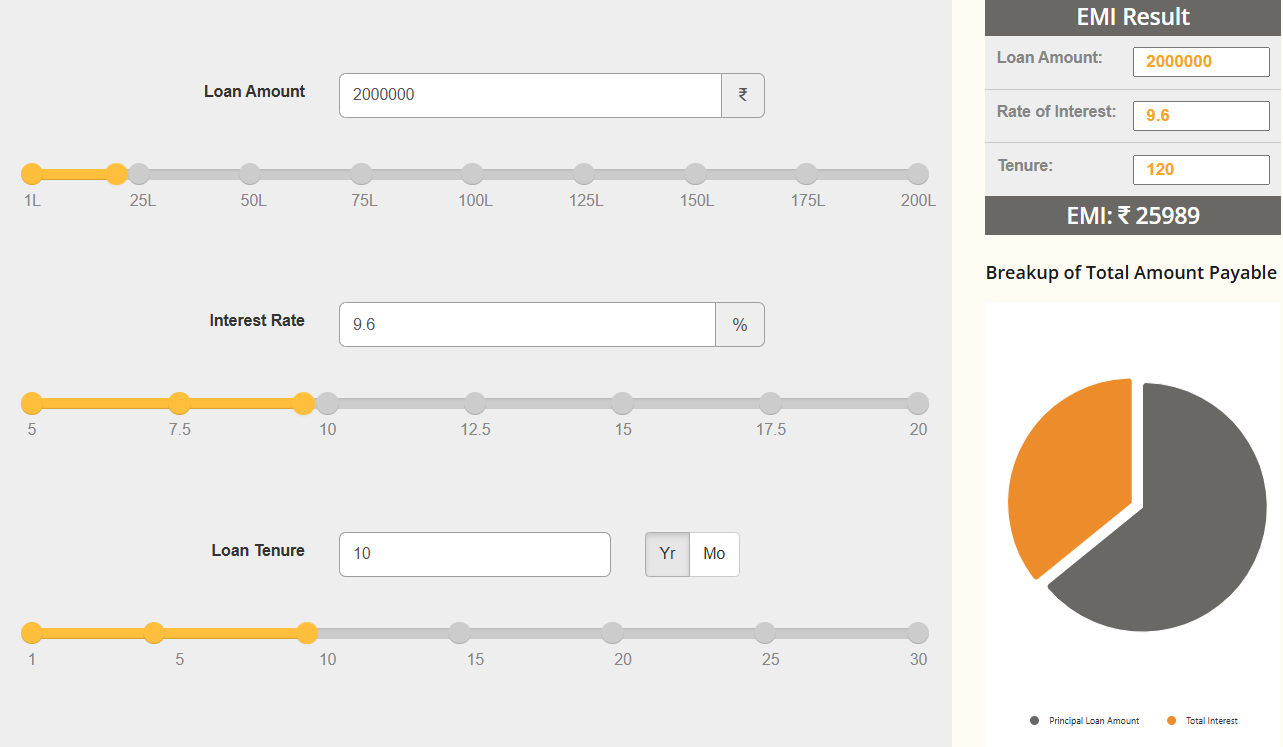

Bank of India Abroad Education Loan EMI Calculator

See how much you can Save!

For instance, if you take a loan of Rs.20 lakhs with an interest rate of 9.6%, to be repaid over 10 years, your repayable EMI is Rs.25,989.

Expenses Covered Under Bank of India Abroad Education Loan

What exactly does BOI’s Star Education loan for abroad studies take care of once you step into student life abroad? Well, that clarity is what makes financial planning feel manageable instead of overwhelming.

-

Tuition Fees: Paid directly to the overseas university or institution as per the official fee structure.

-

Accommodation Costs: Covers hostel fees or approved rented housing expenses near the campus.

-

Living Expenses: Supports basic day-to-day costs such as food, utilities, and local commuting.

-

Books & Study Material: Includes textbooks, reference material, instruments, and course-required equipment.

-

Examination & Academic Fees: Covers exam fees, library charges, and other mandatory institutional costs.

-

Travel Expenses: One-way airfare from India to the country of study.

-

Laptop / Computer Purchase: Allowed when required for academic learning and coursework.

-

Refundable Deposits: Includes caution deposits or building funds, backed by official institutional receipts.

-

Life Insurance Premium: Covers life insurance for the student or co-borrower for the full loan tenure.

-

Other Education-Related Expenses: Any additional costs directly linked to education and approved by the bank.

Expenses tell you where the money goes. Benefits tell you how the loan works in your favour while you are busy studying, settling in, and planning your future. So once the ‘what’ is clear, it is time to look at the ‘why.’ Let us break down what makes Bank of India’s abroad education loan worth considering.

Benefits of Bank of India Abroad Education Loan

An education loan should be making studying abroad easier and not adding another layer of stress. So, instead of complicated charges and rigid rules, Bank of India abroad education loan focuses on flexibility, transparency, and student-friendly features that actually matter once your course begins.

-

Zero Processing and Documentation Charges

-

No Hidden or Surprise Fees

-

No Prepayment Penalty

-

Collateral-Free Loan up to Rs.7.50 Lakhs

-

No Margin Requirement up to Rs.4.00 Lakhs

-

Support for Online and Hybrid Learning Fees.

-

Convenient Fee Payments through Digital Gateways

-

Loan Takeover Facility Available

The benefits are what you see on stage: zero fees, flexible rules, and fewer worries during your study abroad journey. But every smooth performance has a backstage that keeps it running. In this case, the backstage is documentation. Especially for collateral-backed loans, having the right papers ready can decide how fast things move.

Required Documents for Bank of India Abroad Education Loan Against Collateral

When collateral is involved, the bank mainly wants clarity on three things: who you are, where you are studying, and what asset is backing the loan. Once those boxes are ticked, the process moves faster than most students expect. Below is a clear breakdown of documents required, so you can plan everything in advance instead of scrambling after the sanction letter.

Student Documents

-

KYC documents (Passport, Aadhaar, PAN)

-

Academic records (10th, 12th, graduation mark sheets)

-

Admission letter from the overseas university

-

Course fee structure

-

IELTS / TOEFL / PTE scorecard (if applicable)

-

2 Passport-size photographs

Co-applicant Documents

-

KYC documents (PAN, Aadhaar, address proof)

-

Income proof (Salary slips / IT returns / Form 16)

-

Bank statements (last 6 months)

Collateral Documents

-

Property title deed (clear & marketable title)

-

Sale deed / conveyance deed

-

Approved building plan (for constructed property)

-

Latest property tax receipts

-

Encumbrance certificate

-

Legal opinion and valuation report (bank-approved)

Now this is the stage where many students pause and think, ‘What if I miss something?’ And honestly, that is a fair concern. It is not that the papers are impossible to arrange, but knowing what comes first, what goes where, and what the bank actually checks for education loan eligibility can get confusing. With Élan Overseas Education Loans, students don’t have to figure out the process alone.

Step-by-Step Application Process for Bank of India Abroad Education Loan Through Élan Overseas Education Loans

Applying for an education loan directly at a bank branch can sometimes feel like walking into a maze - different desks, different answers, and a lot of back-and-forth. Élan Overseas Education Loans simplifies this journey by coordinating documentation, bank communication, and follow-ups. Now, let’s see how the application process moves forward, step by step.

Step 1: Profile Evaluation

Élan reviews your academic background, university admit, course cost, and collateral value to confirm eligibility under Bank of India norms.

Step 2: Document Checklist & Preparation

You receive a customised checklist based on your profile. Élan helps verify documents before submission to avoid rejections or delays.

Step 3: Loan Application Submission

The complete application is submitted to Bank of India along with properly arranged documents and collateral details.

Step 4: Property Valuation & Legal Check

The bank conducts legal scrutiny and valuation of the collateral property through approved vendors, coordinated by Élan.

Step 5: Loan Sanction Letter Issued

Once approved, the sanction letter is issued, mentioning the loan amount, interest rate, and terms.

Step 6: Disbursement as per University Timeline

Fees are disbursed directly to the university as per semester or annual requirements.

So yes, Bank of India isn't just the bank your family trusts for savings accounts – it is also backing thousands of students who are turning their study abroad dreams into boarding passes and university IDs. With a competitive education loan interest rate, flexible repayment terms, and coverage that goes beyond just tuition fees, the Star Education Loan checks the boxes that matter.

But knowing about a loan and actually getting it sanctioned without stress are two very different experiences. That is where having someone in your corner makes all the difference. So, for personalised clarity and expert support, it is always best to speak with the experts at Élan Overseas Education Loans. Because when the paperwork, expenses, and education loan interest rate are well understood, the journey feels far less intimidating and far more achievable!

FAQs

1. Is Bank of India education loan available for students admitted to private or lesser-known foreign universities?

Yes, Bank of India considers loans for recognised overseas institutions, provided the course and university meet eligibility norms such as accreditation, ranking criteria, and employability prospects. University ranking, course relevance, and future job outcomes play an important role in approval.

2. Can a Bank of India abroad education loan be used for multiple disbursements across semesters?

Yes, the loan amount is usually disbursed in stages, aligned with the university’s fee schedule. This includes semester-wise tuition payments and periodic living expense disbursements, rather than releasing the entire amount at once.

3. Does Bank of India allow joint ownership property as collateral for an abroad education loan?

Jointly owned properties can be considered as collateral, provided all owners give consent and the legal title is clear. The bank’s legal team evaluates ownership structure, shareholding, and encumbrance status before approval.

4. What happens if a student changes the university or course after loan sanction?

Any change in university, country, or course must be informed to the bank. Approval depends on whether the revised institution and course still meet Bank of India’s eligibility criteria. In some cases, the sanction terms may be revised.

5. Can education loan repayment start earlier than the moratorium period?

Yes, borrowers can voluntarily start repayment during the study or moratorium period if they wish to reduce the interest burden. Early repayment does not attract penalties under the Bank of India abroad education loan scheme

6. Is the Bank of India abroad education loan applicable for dual-country or transfer programs?

Dual-country or transfer programs may be considered if both institutions are recognised and the overall program structure is clearly documented. The bank evaluates the full academic pathway before making a decision.

- Share this Article

Articles on Overseas Education Loans

Education Loan for MBA in Ireland

As a tourist, one may associate Ireland with lush natural scenery, rich cultural...Dec 31, 2025

Education Loan for Japan

Japan, the Land of the Rising Sun, is a technological and economic marvel...Dec 29, 2025

Abroad Education Loan for CA Students

Becoming a Chartered Accountant is a lot like training to be the financial ‘doctor’ of...Dec 24, 2025

Login

Login